By Mia Leach February 12, 2025

The CBD Industry faces several challenges in payment processing but one of the major issues is the risk of high chargebacks due to the number of strict regulations in the industry. Proper management of chargebacks is very crucial for streamlined payment processing and cash flow without any risk of chargebacks.

This article explores simple yet effective risk management techniques tailored to CBD payment processing so that your business remains streamlined without any hindrance to your revenue.

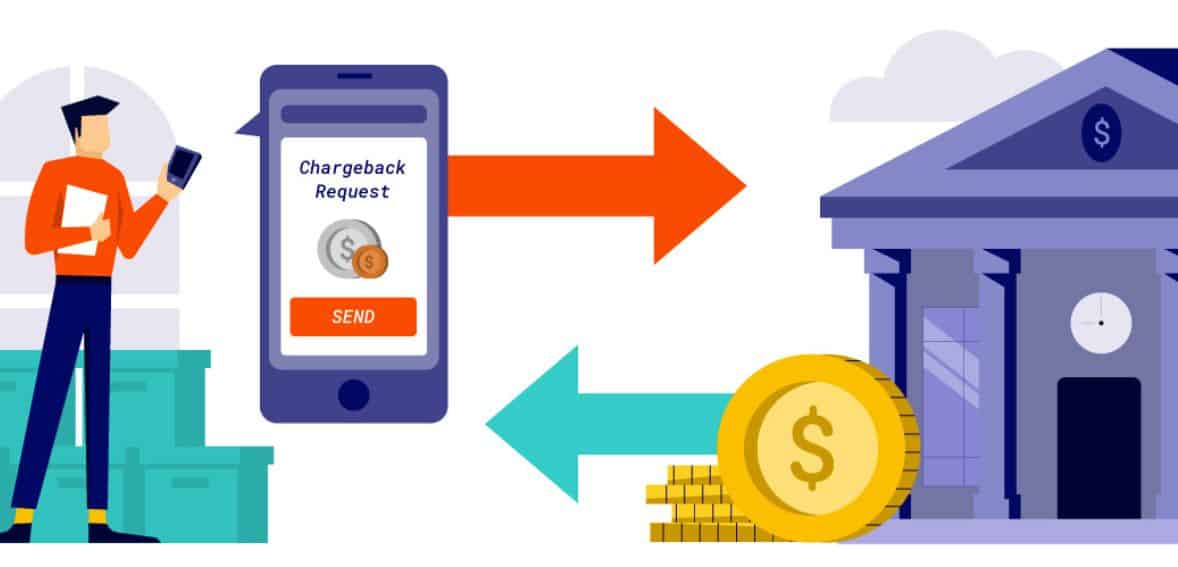

What Is Chargeback in Payment Processing

Chargeback payment processing is a mechanism that allows customers to dispute a transaction made with their credit or debit card. If a customer believes a charge was unauthorized, fraudulent, or incorrect, they can request a chargeback through their bank or card issuer.Here’s how the process works:

- Customer Dispute: The customer immediately contacts their respective bank to dispute a charge, providing a proper reason such as not receiving the product, receiving a defective product, or suspecting potential fraud.

- Investigation: The bank immediately starts investigating the claim by reviewing the transaction details and reaching out to the merchant for evidence to support the validity of the charge.

- Temporary Reversal: While the investigation is ongoing, the transaction amount is temporarily reversed from the merchant’s account and credited back to the customer.

- Resolution: If the merchant provides sufficient evidence that the charge was legitimate, the funds are returned to the merchant Securely. If the customer’s claim is validated, the chargeback becomes permanent to the customer.

Risk Management Techniques for CBD Payment Processing

The CBD Industry is considered one of the high-risk industries with major challenges such as the risk of high chargebacks and strict regulations, evolving consumer perceptions. To effectively secure revenue and maintain streamlined payment processing the CBD industry should effectively implement risk management strategies for high chargebacks.

Below are some simple yet effective techniques to minimize chargebacks and mitigate risks in CBD payment processing:

Be Transparent with Customers

One of the common reason customers files chargebacks against any industry is the lack of proper transparency which can create confusion for the customer leading to misunderstanding and chargebacks. Always make sure your billing descriptors are clear and recognizable for customers. This will reduce confusion and misunderstanding with customers and will lead to more trust.

Secure Payment Gateways

In today’s world where fraud risk and cyber security a major risks, a secure payment gateway is key to dealing with online payments. Always choose a payment gateway with advanced tools such as fraud protection and multi-factor authentication. This not only builds trust with customers but also reduces the risk of fraudulent chargebacks.

Reliable Shipping and Tracking

Proper communication with the customer is the key to fostering better trust. Always communicate with the customer if there are any unfortunate delays and keep them informed on when exactly they will receive the order, always remember nothing frustrates a customer more than a late delivery, and always keep them on track to avoid charges.

Responsive Customer Support

Customer support is key to avoiding any unnecessary chargeback. Make it easier for customers to always reach out to you whether by phone, email or live chat for quick and effective support, this helps you to address issues before they can turn into chargebacks, and a customer is less likely to go directly for a charge if they feel their problem is addressed.

Work with a CBD-Friendly Payment Processor

Always choose CBD-friendly payment processor for proper work management as choosing the wrong payment processor can lead to several issues including account freezes or higher chargeback rates. Look for a payment processor that specializes in high-risk industries like CBD, these payment processors have advanced tools to address the unique challenges faced by high-risk industries like CBD.

Keep Detailed Records

Keeping detailed records is another effective way of dealing with chargebacks, always proper records for sales receipts, shipping confirmations, and customer communications. This will help you keep accurate evidence if any dispute arises in the future to fight chargebacks.

Monitor and Adapt

Keep track of your chargeback ratios and payment trends to identify any recurring issues. Keeping track of your chargebacks and payment trends will help you plan an effective strategy for potential future chargeback risk.

Managing the risk of chargeback in the CBD industry is not easy but with an effective risk mitigation strategy you can minimize any potential risk of chargebacks and stay ahead of any recurring issues.

What to Look for In a CBD Payment Processor

High-Risk Industry Experience

When choosing a payment processor for the CBD industry always look for a payment processor experienced with high-risk industries. Choosing a high-risk payment processor can offer several benefits for dealing with chargebacks as these payment processors are equipped with advanced tools to deal with chargebacks and fraud.

Transparent Fee Structure

Choose a payment processor that will provide transparent pricing, as the high-risk industry more likely faces several challenges including higher fees, choosing a transparent processor will help ensure there are no hidden charges for transactions, chargebacks, or account maintenance.

Secure Payment Gateway

Choosing a well-secured payment processor will help ensure streamlined payment processing without any potential risk. A secured payment processor with tools like multi-factor authentication and PCI compliance is necessary for the protection of customer data.

Multiple Payment Options

For a better customer experience and smooth cash flow look for a payment processor that allows multiple payment methods including credit cards, debit cards, ACH transfers, and digital wallets.

Reliable Customer Support

Always look for a payment processor with reliable customer support, responsive customer support will help you deal with potential issues before they turn into chargebacks.

Compliance with Regulations

Always ensure the payment processor’s compliance with the federal and state legal regulations related to CBD transactions. This will ensure there are no legal issues that could impact payment processing.

Integration and Scalability

Choose a processor that integrates seamlessly with your e-commerce platform, CRM, and accounting software. Additionally, ensure it can scale with your business as it grows.

Reputation and Reviews

While choosing a payment processor always research first on reviews and testimonials of other CBD businesses to get a better idea of the processor’s reliability, services and overall reputation in the industry.

By selecting a payment processor with these important features a CBD business can manage any potential complexity of a payment processor easily while effectively ensuring a smooth transaction for customers.

Conclusion

Choosing the right payment processor is crucial for the success and stability of a CBD business. With the industry’s unique challenges, including high chargeback risks and strict regulatory requirements, it’s essential to work with a payment processor experienced in high-risk transactions. By prioritizing transparent fees, secure payment gateways, reliable customer support, and compliance with regulations, CBD businesses can minimize risks and provide a smooth payment experience for their customers.

As the CBD market continues to grow, partnering with the right payment processor will not only safeguard your revenue but also support your business’s long-term success.

FAQs

Why do CBD businesses need a specialized payment processor?

CBD business is considered one of the high-risk industries due to strict regulations and high chargeback risk. A specialized payment processor can address these unique challenges with advanced tools tailored for high-risk chargeback issues.

What Should Look for in a CBD Payment Processor?

Always look for a payment gateway experienced in the high-risk industry, advanced chargeback tools, transparent prices, compliance with legal regulations and responsive customer support.

Can I Use Regular Payment Processors for CBD Products?

Most traditional payment processors do not support CBD transactions due to legal uncertainties. Choosing a CBD-friendly processor ensures compliance and reduces the risk of account closures or payment disruptions.